Multi Asset (equal weight)

single pool that contains all the assets, allowing point-to-point exchanges rather than requiring two hops for crosses; all assets have the same weight

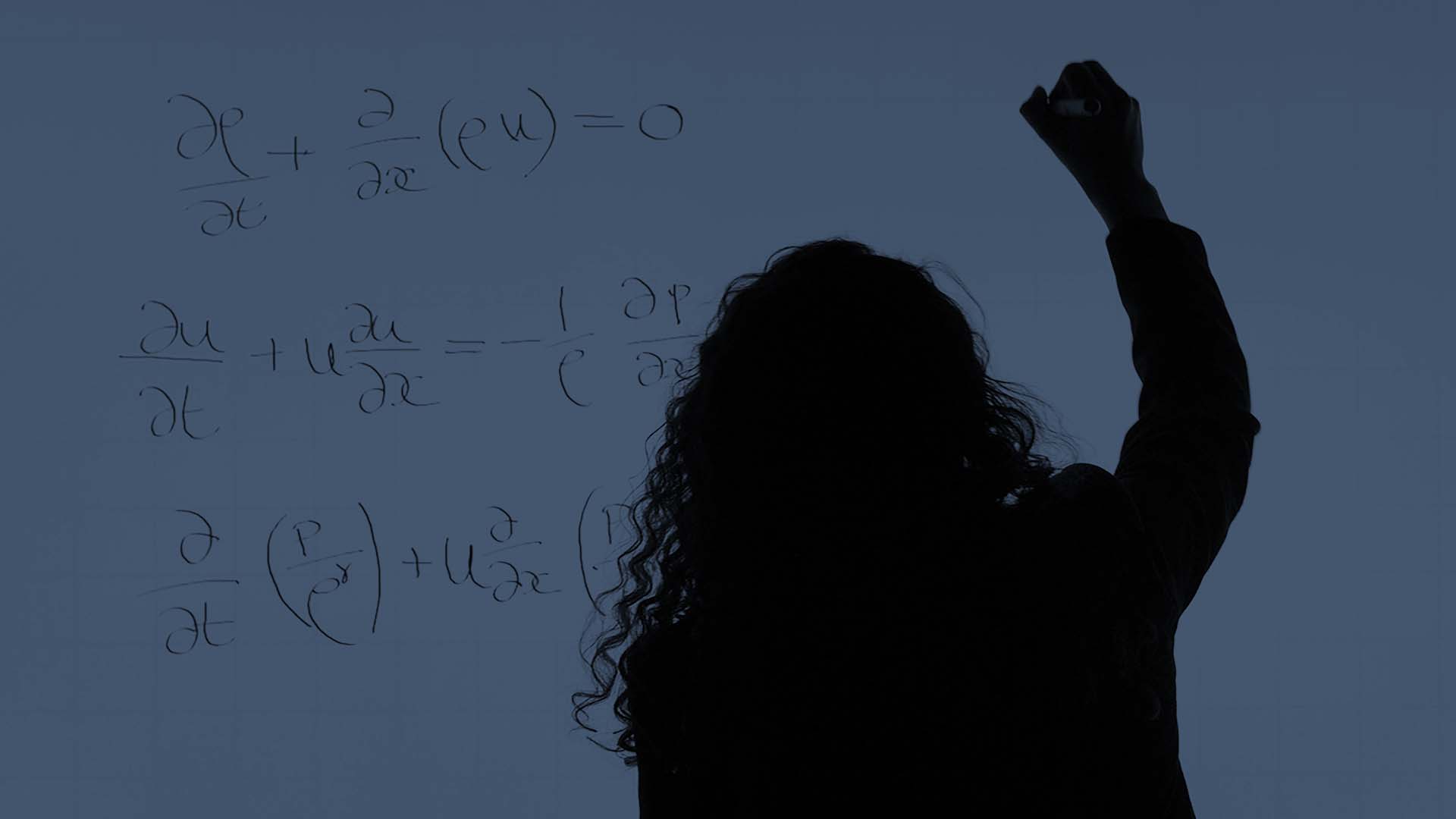

Key formulas

Characteristic function

As in the case of two assets one could use the straight product of the constituent assets, but if the geometric average is used then the constant scales like a currency and is therefore a useful measure for the size of the pool independent of trading.

We have used assets to allow for a numeraire. Our (arbitrary) convention is that is the numeraire, and are the risk assets. As usually, token quantities are measured in their own native currency amounts.

Indifference surface

Like in the two dimensional constant product case, the exponent of the constant ensures that scales like a currency.

Price response function

The middle formula may look somewhat surprising compared to the two-dimensional one, but ultimately the good way of writing it is the one on the right that reduces to in the two dimenional case.

AMM portfolio value

Again a very consistent extension of the 2 dimensional formula to higher dimensions where the portfolio value function remains (almost) the geometric averages of the prices (technically is is the geometric average to the power )

Divergence loss

Again, no surprises here. All that changes is the valuation of the reference portfolio.

Notes

Note that financial derivatives become much more complex in higher dimensions. The reason for this is the existence of correlations and cross-dependencies in the profile, so where before we had 1 second derivative we now have second derivatives along the axis', and cross derivatives. Whilst we can match the Gamma along the axis' with regular calls and puts it is not clear with what we could match the cross convexity.

Whilst reasonable care has been taken to verify the above formulas they may still contain errors. Please do not use them without independent verification.